Cash Advance apps that work with Chime can come as a life saving factor especially when you are in a tough situation such as medical bill but you are out of cash.

Cash advance apps are more like credit cards in that, you can obtain a payday advance before your payday.

Chime is a popular financial institution that provides its customers with online banking services.

Cash Advance apps that work with Chime are also important in situations where you have already gotten lots of debts on your credit card and do not want to damage your credit score by taking more debts.

It is of no doubt that Cash Advance apps are widely used nowadays since they bridge the gap between pay checks without resorting to exploitative payday lenders. For this reason, you can also find Cash Advance apps that work with Cash App.

If you own a Chime bank account, then you will probably need a cash advance app that operates smoothly with this financial institution.

In this article, I will talk about the cash advance apps that work with Chime and which you can use to obtain a payday loan.

Table of Contents

What is Chime?

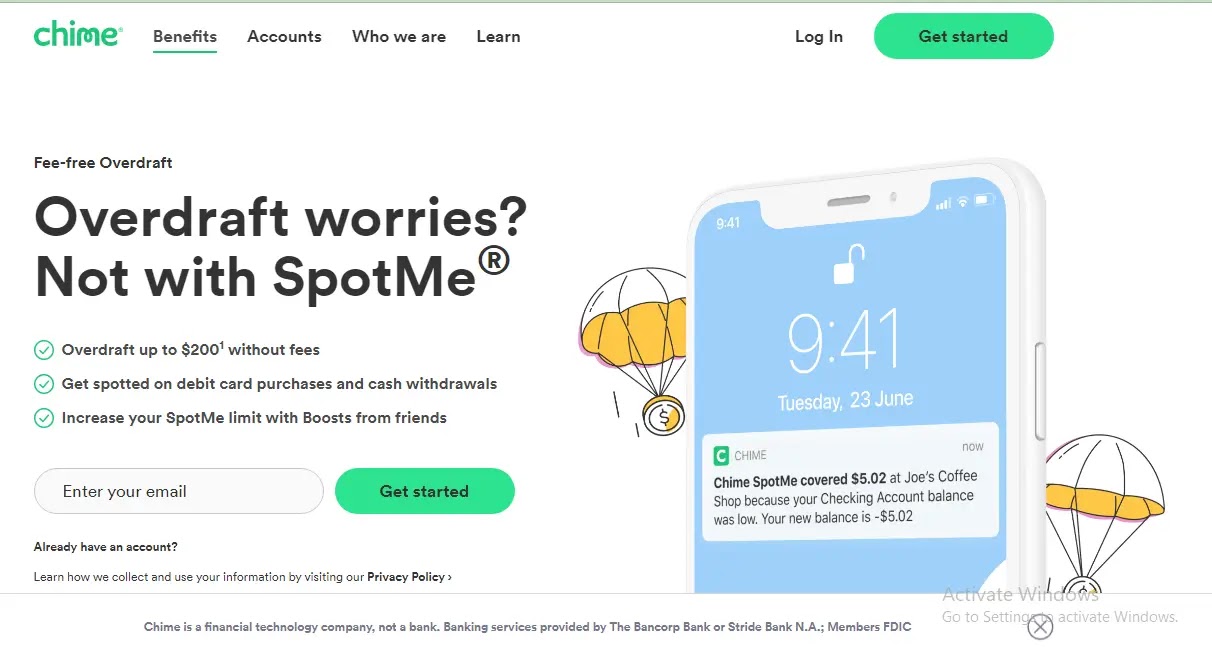

Chime Financial, Inc. is a financial technology company based in the United States and they offer fee-free mobile banking services through the Bancorp Bank or Stride, N.A.

Chime account holders are provided with Visa debit or credit card as well as access to the financial institution's online banking system, which can be accessed via the company's website or mobile app.

The main way through which Chime makes its money is by collecting interchange fees.

Chime is simply a virtual bank with no physical locations and no monthly or overdraft fees. Around February 2020, Chime counter 8 million registered users.

Chime's partners offer bank accounts that are covered up to the standard maximum deposit insurance value of $250,000.

With Chime, you can have a savings account as well as a secured credit card for credit building. But before you can make use of these products, you must first of all have a spending account.

CHECK ALSO: Where Can I Load My Chime Card For Free?.

How to Open a Chime Account

The first thing you need to do is to complete the enrollment form at member.chime.com/enroll//. This requires less than 2 minutes to open an online banking account with Chime.

Once you have finished with your enrollment, you will receive your Chime Visa Debit card to the mailing address which you provided. Most often, your debit card will get to you within 7-10 business days.

Download Chime's mobile banking app and log into your account. You can transfer funds or set up direct deposit using your existing bank account. When you need it, you can also use Chime.com to access online banking.

Benefits of Using Chime

Get Paid Early: Direct deposits are available up to 2 days before payday.

Easy fee-free payments: You can enjoy sending money to anyone with a bank account without incurring any fee.

Low Fees: There is no monthly fee, minimum balance fee or overdraft.

Large ATM Network: Chime counts 60,000 ATMs spread across the territory.

Though Chime comes with several benefits, there are still some disadvantages such as cash deposits being difficult to come by and online transfers limited to $200 each day.

What is a Cash Advance App?

Cash advance apps can be referred to as digital storefronts where individuals can apply for small loans.

Provided you run out of cash before payday, cash advance apps often referred to as cash apps, offer you short-term loans. You take out a loan and it is automatically repaid. As soon as your paycheck is deposited, the app withdraws it.

In most situations, cash advance applications do not charge interest. Some apps charge a fee while others simply encourage users to leave tips.

How Does Chime Work With Cash Advance Apps?

As an individual who does not know how to mange your money, you can easily get yourself into financial difficulties.

If you need a little amount of cash but are hesitant to take out a loan, then you should seek an alternative kind of financing that does not demand collateral.

With Chime, you can easily obtain short term loans for several reasons, not just financial emergencies.

You can also use it to make payments or online purchases without having to worry about accruing interest.

CHECK ALSO: How To Borrow Money From Chime [Complete Guide].

10 Cash/Payday Advance Apps That Work With Chime

| Cash Advance App | Works With Chime | Max cash Advance |

|---|---|---|

| Empower | Yes | $250 |

| Cleo | Yes | $100 |

| MoneyLion | Yes | $250 |

| Branch | Yes | $500 |

| Dave | Yes | $100 |

| Albert | Yes | $250 |

| Klover | Yes | $100 |

| Varo Advance | Yes | $100 |

| Earnin | Yes | $100 |

| Chime SpoMe | Yes | $200 |

1. Dave

Dave is one of the cash advance apps that work with Chime and it lets you get cash before payday.

With a Chime account, you can obtain up to $100 advance and if you have a Dave direct deposit, you can obtain up to $200 advance.

The amount of the advance depends on 2 qualifies direct deposits, expected income, deposit and transaction history for the previous 2 months, the amount of money you retain in the account, and whether you have had recent negative balances on the account.

Dave is a tip-based app with a $1 monthly subscription.

How to Link Chime to Dave

- Open Dave App.

- Got to the Profile Tab.

- Select Linked Banks and Card.

- Tap Change next to Linked Banks.

- Choose bank and continue.

2. Cleo

In the Cleo app, you will see a money management feature that lets you link your bank account and track spending and deposits.

With Cleo, you can borrow funds depending on your spending patterns and balances if you have been a long term customer. In order to receive a salary advance of up to $100, you will need to sign up for Cleo Plus.

3. Albert

Albert another amazing cash advance app that works with Chime.

With respect to your salary, Albert can provide you a cash advance anywhere ranging from $100 to $250. Albert is free, but offers a premium service, known as Albert Genius, at $3.99 per month.

Some of the genius features include; Personal finance tips and advice from live experts, a 1% incentive on your savings and a micro-investment account.

How to Link Chime to Albert

- Open Albert app.

- Navigate to the Budget tab.

- Tap + at the top of the screen.

- Choose Chime, or search for it by name if it is not listed.

- On the next screen, you will have to enter your Chime account details.

4. Empower

Empower is also one of the Cash advance apps that work with Chime.

Qualified members who open an Empower checking account can enjoy a $250 interest-free advance available for them.

In order to be eligible for this, you need a healthy bank account, periodic deposits of more than $500 from your company, and a $8 monthly subscription fee.

More to that, you must have made 2 deposits of at least $100 in the preceding 2 months and maintained a balance of not less than $100 for ten days in the previous 30 days.

How to Link Chime to Empower

- Move to the Home page of your Empower app.

- Scroll down the Accounts section.

- Click on the + icon on the upper right.

Klover

Klover is a cash advance app based in IIIinois and was founded just of recent in the year 2019.

In order to be eligible for a cash advance from the Klover app, you will need 3 direct deposits to your primary checking account from the same employer within the previous 2 months.

Your paycheck must average $250 or more per week, you must have a bank account of not less than 3 months of history and you must make regular deposits - monthly or weekly.

It is necessary you know that deposits made on a monthly or semi-monthly basis are not accepted.

Klover features budgeting tools and overdraft protection. They make use of a point system so as to increase your borrowing limit.

Due to their restricted partnership, Chime users can only be approved for a $20 upgrade. Though they recently began working with Chime, they are still doing all best to try and serve all Chime clients.

All Chime customers are enrolled in a points program, which requires them to earn points in order to pay out.

You can earn points by doing any of the following; watching advertisement, scanning receipts, and referring friends.

6. MoneyLion

With MoneyLion, you can borrow up to $1000 interest-free with the option of tipping to keep it that way.

What you need is a 2 months old bank account with monthly income deposits and a positive balance.

Among the additional services that MoneyLion offers, you will find credit builder loans, checking accounts, managed investment, personal loans, and credit score tracking.

How to Link MoneyLion to Chime

- In order to link MoneyLion to Chime, click on the "Add Account" button under the Transfers section.

- Choose Add Account option..

7. Earnin

Earnin is another cash advance app that works with Chime, but it has a unique feature known as Balance Shield that makes it different from other cash advance apps.

Customers that make use of Balance Shield Alerts will receive a push message anytime their bank balance goes below a certain amount, up to $400.

Earnin customers can also set up Balance Shield Cash outs, which preemtively cash out up to $100 of their earnings if their balance goes below $100.

Earnin is actually testing new ways to support Chime users and is letting a limited sample of Chime users to use its plaform.

8. Varo

Varo is actually a full-features online banking platform with many of the same banking features as Chime. With Varo, you have right to a debit card with access to a large ATM network, as well as a selection of additional products, such as high-yield savings accounts with interest rates as high as 3%.

If you have an active account of at least 30 days old, Varo will issue you a cash advance of up to $100. It is also necessary that you have a minimum of $1000 in direct deposits in the previous 31 days. You will be given between 15 and 30 days to repay the money.

It is notice that most account holders who receive a Varo cash advance will simply deposits the funds into their Varo account and then withdraw then using their Varo debit card.

In case you want to use Chime, go to Accounts in your Varo app, choose Link an Account, search for Chime and then log in.

Varo also gives out loans to its customers, you might want to check out this article on how to borrow money from Varo.

9. Branch

Branch can be useful for Chime users, but there a little inconvenience, If you bank with Chime, you will be required to put your direct deposit in your Branch Wallet in order to qualify for an advance, according to the Branch support page.

In order to add Chime to Branch, select Settings, then Payment Methods. You can add a new bank or card at the bottom of the Payments Methods page. Choose "Bank" and then "Chime from the "Add Bank or Card" menu.

10. Chime SpoMe

SpotMe is actually the easiest way to start looking for Cash advance apps that work with Chime, as it is Chime's own advance program.

Once you have a Chime bank account and have received $500 in direct deposits in the last 31 days, you are considered eligible for SpotMe.

In order to meet up with the requirements, you must keep on receiving $500 every 31 days.

Once you signh up, you will be given a Spotme limit which often begins at $20..

Depending on your deposit history, you may be eligible for a maximum of up to $200.

It is necessary you have in mind that you cannot withdraw cash or fund a transfer with SpotMe.

Cash Advance Apps That Do Not Work With Chime At the Moment

There are several cash advance apps out there, with each app having its own capabilities and not all of them are compatible with Chime. Below are some few Cash Advance apps that do not work with Chime.

Brigit

Brigit is a cash advance app that can also serve the purpose of a budgeting tool. Though its basic membership is free, it does not let you access all of the site's features.

With Brigit, you can get fast access to cash advance any time you want by subscribing to Brigit Plus which cost $9.99 per month.

Due to connectivity reasons, Brigit does not work with Chime, Capital, Netspend, or Varo.

Possible

Possible is a cash advance app that is available in only 20 states, and you must have a state issued ID, 3 months transactions history, and a positive checking account balance to qualify.

Fees here vary according to state and you are able to borrow up to $500 with various payments spread out over several pay periods.

Final Thoughts on Cash Advance Apps That Work With Chime

Cash Advance apps that work with Chime can come as a life saving factor especially when you are in a tough situation such as medical bill but you are out of cash.

Cash advance apps are more like credit cards in that, you can obtain a payday advance before your payday.

Cash advance apps, mostly known as payday advance apps, let you borrow money from your previous paycheck before your next payment comes.

These apps are also known as early salary access apps, and they are a digital version of a payday loan company.

Though it is a less expensive option to payday loans, you should avoid making this a habit.

Frequently Asked Questions

Can you get a cash advance with chime?

Yes you are able to obtain cash advance with Chime.

What apps will let me borrow money instantly?

There are several apps that lets you borrow moeny instantly. One of this apps include Earnin.

Can you get a loan with Chime bank?

Chime Instant Loans provide easy access to money when you need it to cover an important expense.