Chime is a well known online bank that provide its customers with numerous services. Chime users are wondering how to borrow money from Chime. Borrowing money from Chime is a quite simple process and you will not find it complicated if you are eligible.

Chime is a financial institution that offers online banking services including an online checking account and a virtual debit card.

Any financial institution that offers loans to its customers knows how vital it is to maintain trust between the financial institution and the customer and Chime takes this aspect very seriously.

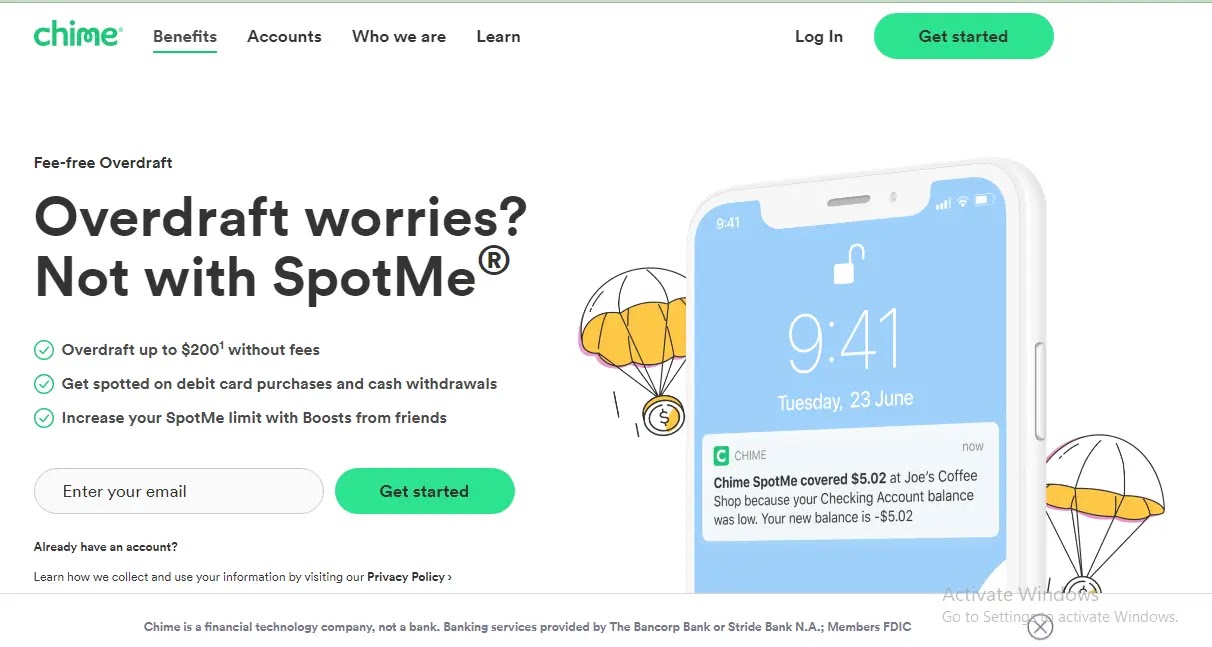

Chime has a feature known as SpotMe which lets eligible customers get a loan ranging from $20 to $200.

Chime SpotMe works in a similar way to Cash Advance app that work with Chime as both let you obtain a Cash advance which you will have to repay on your next Payday.

Want to know how to borrow money from Chime? then stay glued to this article as I will show what it takes to be an eligible Chime user to enjoy Chime's loan.

Table of Contents

What is Chime SpotMe?

SpotMe is a free service that lets Chime Checking account members with an active debit card to carryout certain transactions that might otherwise overdraw their account.

If you are in need of a little more cash to help you cover your expenses, then SpotMe can of help to you.

Once you meet up with the requirements for the feature, you will be able to overdraw your account by up to $20 and switch it on in your App.

Chime has the right to increase this limit based on the history of any Chime branded accounts you have, direct deposit history and quantities, spending behavior and other risk related considerations.

Move to Settings on your and app and discover your current limit.

Transactions that would result in your account being overdrawn by more than your SpotMe limit will be refused, and you will not be charged any fees.

Your limit can be modified by Chime at any time as they have the right to do so. Even though there are no overdraft fees, ATM transactions may be subject to out-of-network or third party costs.

SpotMe does cover non-debit card transaction, including ACH transfer, Pay anyone transfer and Chime checkbook transactions.

Features of Chime SpotMe Loan

- You will be able to handle a majority of other services since the dashboard of your SportMe online account lets you do so.

- You can choose to pay off the debt earlier and there will be no charge for the penalty.

- You will receive a prepaid card that will let you access more authorized loans with more favorable terms.

- Applicants have the option of paying in 16 days or 3 months. The payback period is variable and can be shortened or lengthened depending on your needs.

- You can complete the whole application procedure online and after been approved for the loan, you will have immediate access to the funds.

ALSO READ: How to Borrow Money from PayPal [Best PayPal Loan Options].

Eligibility Requirements to Get SpotMe and Borrow Money From Chime Bank

In order to be eligible for SpotMe at the $20 base limit, you must have received at least $200 in a single direct deposit into your Chime Checking account during the past 34 days.

The deposit must be made through Automated Clearing House (ACH) from your employer, Payroll provider, gig economy, or benefits payer, OR via Original Credit Transaction (OCT) from your economy payer, so as to qualify.

The following types of transactions will not qualify for Chime SpotMe.

- ACH Transfers.

- One-time direct deposit like tax refunds.

- Pay Anyone transfers.

- Verification or trial deposits from financial instituttions.

- Peer-to-Peer transfer from services like PayPal, Cash App, or Venmo.

- Mobile Check deposits.

- Cash Loads or deposits.

If SpotMe is available to you and you have an active debit card, you can switch it on and agree to the terms and conditions under the app's Settings area. After you do this, you will receive a notification alerting you that the functionality has been turned on in your app.

In order to maintain using this feature, you must continue to receive qualifying direct deposits of at least $200 every 34 days.

How to Borrow Money From Chime Bank

Make sure that you have met the basic eligibility requirements by getting a Chime Debit Card and making a qualifying deposit.

Check if you are qualified for the SpotMe feature by going to the Settings tab in your Chime app (ensure you have the latest version of the Chime App).

Agree with the SpotMe Terms an Conditions to enroll into Chime SpotMe.

You will be shown the SpotMe limitation once it is activated. From here, you can now use your Chime Debit Card to make purchases that exceed your bank balance. You can obtain cash at an ATM or use a cashback transaction store like Walmart to get money through self-service out of the POS mahine.

Any money borrowed is deducted from your Chime SpotMe limit and the available balance on the app is updated..

In your Chime checking account, you will see the amount you borrowed as a negative balance.

How Much Can You Borrow From Chime?

You are able to borrow money up to the amount shown on your Chime Mobile App as your SpotMe Limit. This limit varies from one user to another and it is based on the user's account activities and history.

But the range for SpotMe loans is anywhere between $20 to $200.

The Chime Spot Me limit, which determines how much you can borrow, is something over which you have no influence.

Since that is the primary factor used by Chime to establish your eligibility and the amount that can be provided to you, a lot depends on the direct deposit that you receive from your work. It also helps to have a long history with a Chime account and to use Chime goods generally.

You don't have a specific timeframe for when you should anticipate an increase in Chime Spot Me. This is one drawback of borrowing money because you are limited to the amount set by the app.

Sending and receiving SpotMe boosts from other Chime members each month, which temporarily increase your Chime Spot me limit by $5 every boost, is one fantastic Chime Spot me function.

It is advantageous to have Chime users as friends because you can trade boosts with them without affecting your own borrowing capacity.

If the Chime Spot Me Limit does not reassure you, you may find a comprehensive list of different cash advance apps that integrate with Chime in our post on the subject.

ALSO READ: Top 5 Best International Money Transfer Apps.

How to Repay the Money Borrowed From Chime?

One of the key advantages that attracts many individuals to want to borrow money from Chime, is the ease and convenience with which you can borrow money from Chime.

You do not have to be concerned about repaying the money manually on time. Provided that you have a consistent stream of payroll direct deposits, then everything is automatic.

Therefore, any money borrowed through Spot Me (resulting in negative balances on your Chime account) will be immediately refunded before your balance is returned to zero when you get a direct deposit or funds are credited to your Chime Checking account in any other way, regardless of what comes first.

Remember that according to the Chime SpotMe conditions, if a negative balance on your account is not paid off within 90 days of the original sum, Chime may suspend your Chime Checking account.

You will be notified by Chime on what you need to do so as to prevent being suspended.

It is always recommended to pay dues through Visa direct deposit during the same month so that your borrowing ability (Spot Me limit) is not negatively affected.

Does Borrowing Money From Chime Affect Your Credit Score?

Signing up for Chime Spot Me to borrow money does not require a credit check.

One great thing if you read the Chime terms is that they don’t report failure to repay to reporting agencies.

Although this does not stop them from taking legal action against you and will make you ineligible for Chime Spot Me service in the future.

Further, neither Bancorp or Chime will engage in any debt collection activities if the advance is not repaid on the scheduled date, place the amount advanced as a debt with or sell it to a third party, or report any failure to repay to a consumer reporting agency.

So theoretically, your credit score should not be affected and it seems that Chime is on your side.

But it is necessary you keep an eye on the terms from time to time as they can be changed at any time.

How Can You Use Money Borrowed From Chime?

You can use Chime Spot Me borrow money feature –

- Make day-to-day purchases with Chime Debit Card like grocery, online purchases, etc.

- Withdraw in the form of cash from ATM

- Withdraw in the form of cash using a cash-back transaction at a retail store like Walmart, Walgreens, etc.

What you cannot use Chime Spot Me for

- Payments to friends transfer

- Automatic bill payments using Direct Debit from Chime Spending Account

- Transfers to other apps like Venmo and Cash App

- Chime Checkbook transactions.

Final Thoughts on How to Borrow Money From Chime

Chime is a well known online bank that provide its customers with numerous services. Chime users are wondering how to borrow money from Chime. Borrowing money from Chime is a quite simple process and you will not find it complicated if you are eligible.

Eligible SpotMe users are able to borrow between $20 and $200 from Chime which helps them to manage their various issues.

So if you want to borrow a small amount of money for short term requirements, Chime Spot Me is definitely a great option. It can help tide over temporary situation without burning a hole in your pocket and does not impact your credit score.

Frequently Asked Questions

Does Chime allow users to overdraft?

You can take out $200 overdraft from your Chime account. But you must first of all establish a relationship with Chime.

How do You get a Cash advance on Chime?

A cash advance on a credit card means you're borrowing money against your credit card's credit limit. To get a cash advance from a credit card, you have three options: Via an ATM to process the cash advance using your credit card PIN. By visiting in-person to the bank where your card is issued.

Can I Borrow Money From Chime?

Yes Thanks to Chime distinctive SpotMe feature, you can borrow money from the company. It permits you to overdraft by $200 or more without incurring any further cost.

What app lets you borrow with chime?

If you're looking at cash advance apps that work with Chime, the simplest place to start is SpotMe, Chime's own advance program. SpotMe is a no-fee overdraft service. If you have a Chime bank account and you have received $500 in direct deposits in the last 31 days you are eligible for SpotMe.